As the internet that connects humans reaches a stable saturation point the industrial internet — the network that connects things — is increasing its growth and reach.

[div class=attrib]From the New York Times:[end-div]

When Sharoda Paul finished a postdoctoral fellowship last year at the Palo Alto Research Center, she did what most of her peers do — considered a job at a big Silicon Valley company, in her case, Google. But instead, Ms. Paul, a 31-year-old expert in social computing, went to work for General Electric.

Ms. Paul is one of more than 250 engineers recruited in the last year and a half to G.E.’s new software center here, in the East Bay of San Francisco. The company plans to increase that work force of computer scientists and software developers to 400, and to invest $1 billion in the center by 2015. The buildup is part of G.E’s big bet on what it calls the “industrial Internet,” bringing digital intelligence to the physical world of industry as never before.

The concept of Internet-connected machines that collect data and communicate, often called the “Internet of Things,” has been around for years. Information technology companies, too, are pursuing this emerging field. I.B.M. has its “Smarter Planet” projects, while Cisco champions the “Internet of Everything.”

But G.E.’s effort, analysts say, shows that Internet-era technology is ready to sweep through the industrial economy much as the consumer Internet has transformed media, communications and advertising over the last decade.

In recent months, Ms. Paul has donned a hard hat and safety boots to study power plants. She has ridden on a rail locomotive and toured hospital wards. “Here, you get to work with things that touch people in so many ways,” she said. “That was a big draw.”

G.E. is the nation’s largest industrial company, a producer of aircraft engines, power plant turbines, rail locomotives and medical imaging equipment. It makes the heavy-duty machinery that transports people, heats homes and powers factories, and lets doctors diagnose life-threatening diseases.

G.E. resides in a different world from the consumer Internet. But the major technologies that animate Google and Facebook are also vital ingredients in the industrial Internet — tools from artificial intelligence, like machine-learning software, and vast streams of new data. In industry, the data flood comes mainly from smaller, more powerful and cheaper sensors on the equipment.

Smarter machines, for example, can alert their human handlers when they will need maintenance, before a breakdown. It is the equivalent of preventive and personalized care for equipment, with less downtime and more output.

“These technologies are really there now, in a way that is practical and economic,” said Mark M. Little, G.E.’s senior vice president for global research.

G.E.’s embrace of the industrial Internet is a long-term strategy. But if its optimism proves justified, the impact could be felt across the economy.

The outlook for technology-led economic growth is a subject of considerable debate. In a recent research paper, Robert J. Gordon, a prominent economist at Northwestern University, argues that the gains from computing and the Internet have petered out in the last eight years.

Since 2000, Mr. Gordon asserts, invention has focused mainly on consumer and communications technologies, including smartphones and tablet computers. Such devices, he writes, are “smaller, smarter and more capable, but do not fundamentally change labor productivity or the standard of living” in the way that electric lighting or the automobile did.

But others say such pessimism misses the next wave of technology. “The reason I think Bob Gordon is wrong is precisely because of the kind of thing G.E. is doing,” said Andrew McAfee, principal research scientist at M.I.T.’s Center for Digital Business.

Today, G.E. is putting sensors on everything, be it a gas turbine or a hospital bed. The mission of the engineers in San Ramon is to design the software for gathering data, and the clever algorithms for sifting through it for cost savings and productivity gains. Across the industries it covers, G.E. estimates such efficiency opportunities at as much as $150 billion.

[div class=attrib]Read the entire article following the jump.[end-div]

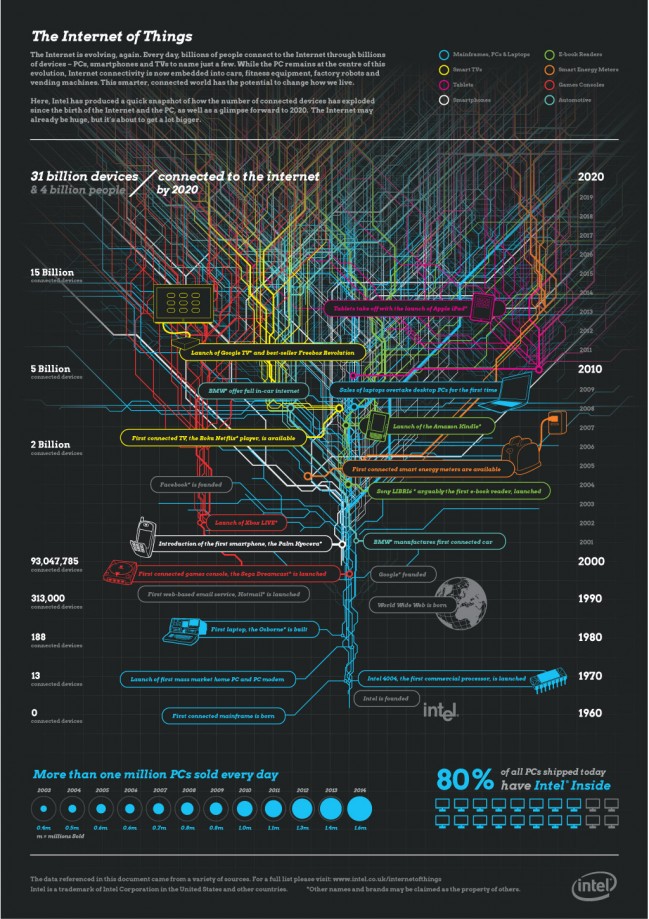

[div class=attrib]Image: Internet of Things. Courtesy of Intel.[end-div]

The term “Internet of Things” was first coined in 1999 by Kevin Ashton. It refers to the notion whereby physical objects of all kinds are equipped with small identifying devices and connected to a network. In essence: everything connected to anytime, anywhere by anyone. One of the potential benefits is that this would allow objects to be tracked, inventoried and status continuously monitored.

The term “Internet of Things” was first coined in 1999 by Kevin Ashton. It refers to the notion whereby physical objects of all kinds are equipped with small identifying devices and connected to a network. In essence: everything connected to anytime, anywhere by anyone. One of the potential benefits is that this would allow objects to be tracked, inventoried and status continuously monitored.