Enemy number one in this case is not your favorite team’s arch-rival or your political nemesis or your neighbor’s nocturnal barking dog. It is not sugar, nor is it trans-fat. Enemy number one is not North Korea (close), nor is it the latest group of murderous terrorists (closer).

Enemy number one in this case is not your favorite team’s arch-rival or your political nemesis or your neighbor’s nocturnal barking dog. It is not sugar, nor is it trans-fat. Enemy number one is not North Korea (close), nor is it the latest group of murderous terrorists (closer).

The real enemy is gravity. Not the movie, that is, but the natural phenomenon.

Gravity is constricting: it anchors us to our measly home planet, making extra-terrestrial exploration rather difficult. Gravity is painful: it drags us down, it makes us fall — and when we’re down , it helps other things fall on top of us. Gravity is an enigma.

But help may not be too distant; enter The Gravity Research Foundation. While the foundation’s mission may no longer be to counteract gravity, it still aims to help us better understand.

From the NYT:

Not long after the bombings of Hiroshima and Nagasaki, while the world was reckoning with the specter of nuclear energy, a businessman named Roger Babson was worrying about another of nature’s forces: gravity.

It had been 55 years since his sister Edith drowned in the Annisquam River, in Gloucester, Mass., when gravity, as Babson later described it, “came up and seized her like a dragon and brought her to the bottom.” Later on, the dragon took his grandson, too, as he tried to save a friend during a boating mishap.

Something had to be done.

“It seems as if there must be discovered some partial insulator of gravity which could be used to save millions of lives and prevent accidents,” Babson wrote in a manifesto, “Gravity — Our Enemy Number One.” In 1949, drawing on his considerable wealth, he started the Gravity Research Foundation and began awarding annual cash prizes for the best new ideas for furthering his cause.

It turned out to be a hopeless one. By the time the 2014 awards were announced last month, the foundation was no longer hoping to counteract gravity — it forms the very architecture of space-time — but to better understand it. What began as a crank endeavor has become mainstream. Over the years, winners of the prizes have included the likes of Stephen Hawking, Freeman Dyson, Roger Penrose and Martin Rees.

With his theory of general relativity, Einstein described gravity with an elegance that has not been surpassed. A mass like the sun makes the universe bend, causing smaller masses like planets to move toward it.

The problem is that nature’s other three forces are described in an entirely different way, by quantum mechanics. In this system forces are conveyed by particles. Photons, the most familiar example, are the carriers of light. For many scientists, the ultimate prize would be proof that gravity is carried by gravitons, allowing it to mesh neatly with the rest of the machine.

So far that has been as insurmountable as Babson’s old dream. After nearly a century of trying, the best physicists have come up with is superstring theory, a self-consistent but possibly hollow body of mathematics that depends on the existence of extra dimensions and implies that our universe is one of a multitude, each unknowable to the rest.

With all the accomplishments our species has achieved, we could be forgiven for concluding that we have reached a dead end. But human nature compels us to go on.

This year’s top gravity prize of $4,000 went to Lawrence Krauss and Frank Wilczek. Dr. Wilczek shared a Nobel Prize in 2004 for his part in developing the theory of the strong nuclear force, the one that holds quarks together and forms the cores of atoms.

So far gravitons have eluded science’s best detectors, like LIGO, the Laser Interferometer Gravitational-Wave Observatory. Mr. Dyson suggested at a recent talk that the search might be futile, requiring an instrument with mirrors so massive that they would collapse to form a black hole — gravity defeating its own understanding. But in their paper Dr. Krauss and Dr. Wilczek suggest how gravitons might leave their mark on cosmic background radiation, the afterglow of the Big Bang.

Continue reading the main story Continue reading the main story

Continue reading the main story

There are other mysteries to contend with. Despite the toll it took on Babson’s family, theorists remain puzzled over why gravity is so much weaker than electromagnetism. Hold a refrigerator magnet over a paper clip, and it will fly upward and away from Earth’s pull.

Reaching for an explanation, the physicists Lisa Randall and Raman Sundrum once proposed that gravity is diluted because it leaks into a parallel universe. Striking off in a different direction, Dr. Randall and another colleague, Matthew Reece, recently speculated that the pull of a disk of dark matter might be responsible for jostling the solar system and unleashing periodic comet storms like one that might have killed off the dinosaurs.

It was a young theorist named Bryce DeWitt who helped disabuse Babson of his dream of stopping such a mighty force. In “The Perfect Theory,” a new book about general relativity, the Oxford astrophysicist Pedro G. Ferreira tells how DeWitt, in need of a down payment for a house, entered the Gravitational Research Foundation’s competition in 1953 with a paper showing why the attempt to make any kind of antigravity device was “a waste of time.”

He won the prize, the foundation became more respectable, and DeWitt went on to become one of the most prominent theorists of general relativity. Babson, however, was not entirely deterred. In 1962 after more than 100 prominent Atlantans were killed in a plane crash in Paris, he donated $5,000 to Emory University along with a marble monument “to remind students of the blessings forthcoming” once gravity is counteracted.

He paid for similar antigravity monuments at more than a dozen campuses, including one at Tufts University, where newly minted doctoral students in cosmology kneel before it in a ceremony in which an apple is dropped on their heads.

I thought of Babson recently during a poignant scene in the movie “Gravity,” in which two astronauts are floating high above Earth, stranded from home. During a moment of calm, one of them, Lt. Matt Kowalski (played by George Clooney), asks the other, Dr. Ryan Stone (Sandra Bullock), “What do you miss down there?”

She tells him about her daughter:

“She was 4. She was at school playing tag, slipped and hit her head, and that was it. The stupidest thing.” It was gravity that did her in.

Read the entire article here.

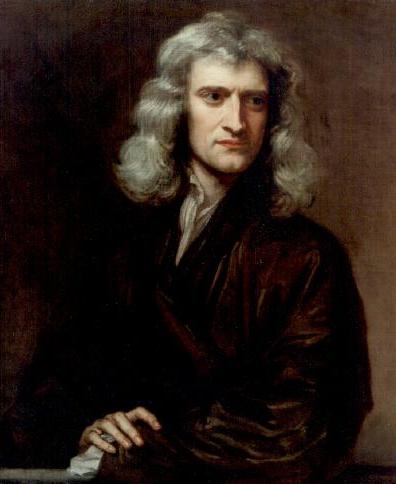

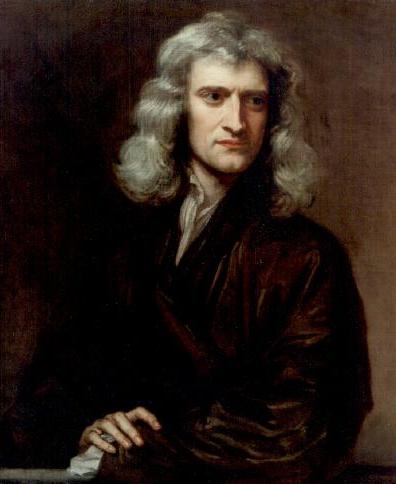

Image: Portrait of Isaac Newton (1642-1727) by Sir Godfrey Kneller (1646–1723). Courtesy of Wikipedia.

If you’ve read my blog for a while you undoubtedly know that I have a rather jaded view of tech startup culture — particularly with Silicon Valley’s myopic obsession for discovering the next multi-billion dollar mobile-consumer-facing-peer-to-peer-gig-economy-service-sharing-buzzword-laden-dating-platform-with-integrated-messaging-and-travel-meta-search app.

If you’ve read my blog for a while you undoubtedly know that I have a rather jaded view of tech startup culture — particularly with Silicon Valley’s myopic obsession for discovering the next multi-billion dollar mobile-consumer-facing-peer-to-peer-gig-economy-service-sharing-buzzword-laden-dating-platform-with-integrated-messaging-and-travel-meta-search app.

OK, so I am thoroughly addicted to yogurt (or yoghurt, for my non-US readers). My favorite is the greek yogurt Fage, followed by an Aussie concoction called Noosa.

OK, so I am thoroughly addicted to yogurt (or yoghurt, for my non-US readers). My favorite is the greek yogurt Fage, followed by an Aussie concoction called Noosa.